Foreign Exchange - A Beginner's Guide

What is Forex (FX) and How does Forex Trading Work?

Trading forex involves buying one currency and selling another simultaneously. Through careful analysis, traders predict the potential direction of currency prices and attempt to capture gains based on price fluctuations. There is no centralised exchange for forex trading. Rather, it takes place electronically or online, between networks of global computers. The market is open 24 hours a day, 5 days a week.

How Do Forex Markets

Work?

Forex is the most popular over-the-counter (OTC) market. In forex, currencies are bought and sold through a network of banks. As there is no exchange, forex trading is decentralised and trading can take place 24 hours per day. There are 4 main trading sessions, namely Sydney, London, New York and Tokyo.

The most popular forex market type is the spot forex market. In forex, spot trades involve the exchange of currency pairs electronically using an online trading platform. Other market types include the forward forex market and futures forex market.

There are 4 major trading sessions.

Keep in mind that timings in some countries, like New Zealand, the US and UK, shift to/from daylight savings time in October/November and March/April. So, plan your trades accordingly. Market liquidity for currency pairs depends on the forex trading sessions. For instance, the EUR/USD pair shows a lot of movement and liquidity during the confluence of the London and New York sessions. The AUD/USD pair shows maximum movement in the Tokyo and London sessions. Once you know when to trade, the next step is to learn the jargon. So, here are some terms and concepts you will come across in the market.

What is a Base

and Quote Currency in Forex?

Currencies are denoted in 3lettered ISO codes. Examples of how major currencies are denoted are USD (US dollar), AUD (New Zealand dollar), EUR (Euro), JPY (yen) and GPB (British Pound).

In foreign currency trading, currencies are quoted in pairs. When you see a currency pair, the first currency is called the base currency and the second currency is the quote currency or counter currency. For instance, say the EUR/AUD is trading at 1.6163. This means to buy 1 unit of Euro, you will need $1.6163 New Zealand dollars.

What Moves

the Forex Market?

There

are a number of factors that have an impact on the forex market. They can split

into two categories;

market participants and macroeconomic factors.

Market Participants

Super Banks: As it is decentralised, it is the world's largest banks that determine the exchange rate. Global banks such as Barclays, HSBC, Citi, JPMorgan and Deutsche Bank are among the biggest traders of forex.

International Companies: Large global corporations are involved in the foreign exchange market for the purpose of doing business. If a New Zealand-based company is selling products in the United States they will have to trade USD to AUD in order to return their income back home.

Retail Traders: Refers to individuals who trade their own money in order to make a profit. Easier access to the forex market through online brokers and advanced trading platforms has resulted in retail traders accounting for a growing proportion of the forex market.

Economic & Macroeconomic Factors

Central Banks: Macroeconomic statistics such as inflation have a significant impact on forex markets. Governments and central banks such as the Federal Reserve meet on a regular basis to evaluate the status of their respective economies, set interest rates and monetary policy - all of which have a direct impact on forex markets.

Capital Markets: The prices of stock, bond and commodity futures also have an influence on foreign exchange markets.

International Trade: Figures relating to the trade numbers of a country have an impact on the value of currency. Trade deficits and surpluses will be reflected by price movements in the forex market.

Politics: This is particularly the case around key political events such as elections and results in high levels of volatility in the forex market. This is evident by historical events such as Brexit in the United Kingdom and numerous presidential election campaigns in the United States.

Forex Quotes /

Exchange Rates

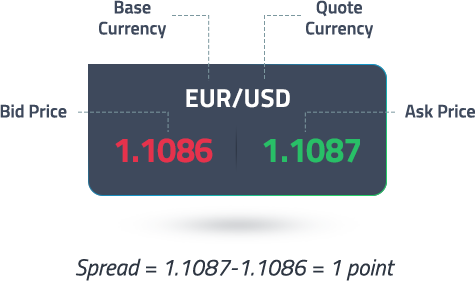

Currencies are traded in pairs, like the Euro/US Dollar (EUR/USD) or New Zealand Dollar/US Dollar (AUD/USD). Currencies are denoted in 3-lettered ISO codes, such as EUR (Euro), GBP (Great British Pound) and USD (US Dollar). When you see a currency quote, the first currency is called the base currency and the second currency is the quote currency or counter currency. For instance, say the EUR/USD is trading at 1.1086. This means to buy 1 unit of Euro, you will need $1.1086. USD

The higher price $1.1087 is the ask rate, while $1.1086 is the bid rate. The bid price is the maximum price a buyer is willing to pay for the currency. Ask price is the minimum price a seller is willing to accept for the same currency. These rates fluctuate constantly, depending on supply and demand, market sentiment and external events.

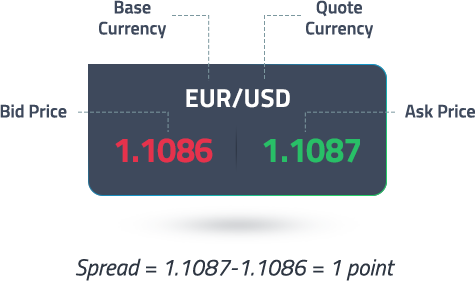

Spread

The difference between these two rates is known as the spread. This includes the broker’s charges. The spread depends on your choice of currency pair and the forex broker. Licensed forex brokers who provide ECN (Electronic Communications Network) pricing can source price quotes from multiple liquidity providers in the market. This means they can offer the tightest spreads.

An Example of

Leverage CFD Trading

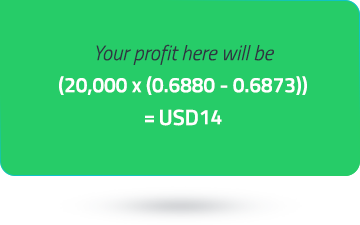

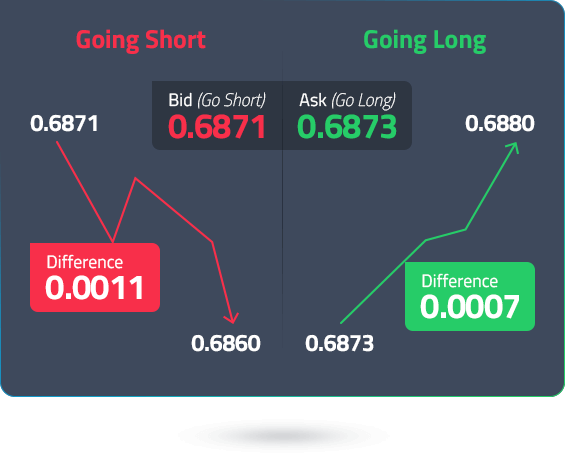

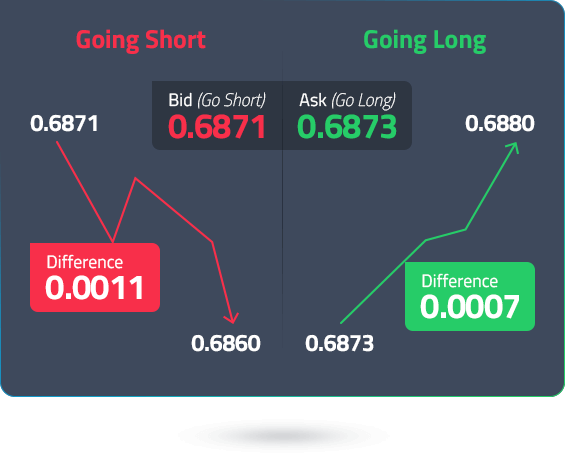

Suppose you want to trade CFDs, where the underlying asset is the AUD/USD currency pair, also known as the “Aussie.” Let us suppose that the AUD/USD pair is trading at:

Bid/Ask Spread

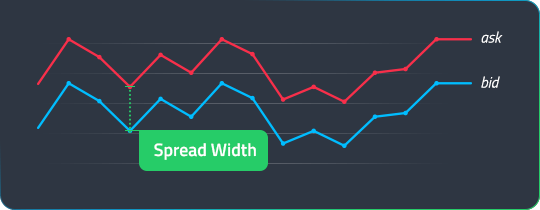

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

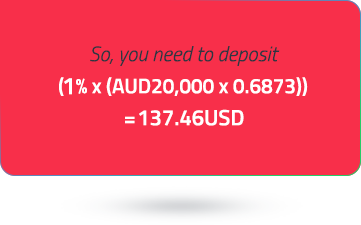

You decide to buy AUD 20,000 worth of USD because you think that the AUD/USD price will rise in the future. Your account leverage is set to 100:1. This means that you need to deposit 1% of the total position value into your margin account.

Now, in the next hour, if the price moves to 0.6880/0.6882, you have a winning trade. You could close your position by selling at the current price of USD 0.6880.

In this case, the price moved in your favour. But, had the price declined instead, moving against your prediction, you could have made a loss. If that loss resulted in your account equity falling below your margin requirements, your broker may issue a margin call.

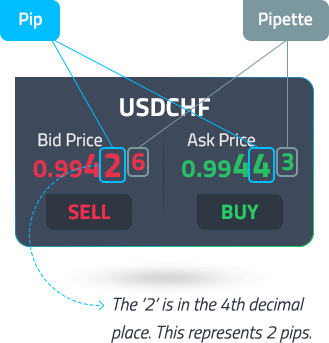

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point.” In the forex market, like in the above example, it is used to denote the smallest price increment in the price of a currency. For assets like the AUD/USD, which include the US Dollar, a pip is represented up to the 4th decimal place. But, in case of pairs that include the Japanese Yen, like the AUD/JPY, the quote is usually up to 3 decimal places.

This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In case your initial margin is lower, the broker will issue a margin call. If you fail to deposit the money, the contract will be closed at the current market price. This process is known as “marking to market.”

What is Pip in Forex?

Pip is an acronym for Point in Percentage. It represents the smallest amount of change in the rate of a currency pair and is a standardised unit. For a US Dollar based currency pair, like the AUD/USD, one pip is $0.0001. However, for some currencies, like the Japanese Yen (JPY), it is denoted as $0.001.

Pip value fluctuations have an effect on trading gains. For example, if you decide to buy €10,000 and the EUR/USD pair is trading at 1.1086, the price you will have to pay will be $(10,000x1.1086) or $11,086.

If the exchange rate for this pair sees a 5-pip increase, which means the EUR/USD is now trading at 1.1091, then to buy €10,000, you will have to pay $11,091.

Forex Majors, Minors and

Exotics

Not all currency pairs are traded in large volumes. The US Dollar, being the world’s reserve currency, is definitely traded the most; although, over the years, its dominance has waned somewhat. Based on how frequently they are traded, currency pairs are segregated into major, minor and exotic categories.

Majors

Major currency pairs have the tightest spreads.

They are:

EUR/USD

Euro/US Dollar (aka Fiber)

GBP/USD

British Pound/US Dollar (aka Cable)

USD/JPY

US Dollar/Japanese Yen (aka Ninja)

USD/CHF

US Dollar/Swiss Franc (aka Swissy)

CAD/USD

Canadian Dollar/US Dollar (aka Loonie)

AUD/USD

New Zealand Dollar/US Dollar (aka Aussie)

NZD/USD

New Zealand Dollar/US Dollar (aka Kiwi)

Minors

Then comes a category of minor currency pairs, otherwise known as cross-currency pairs. They are called so because they do not include the US Dollar. So, to convert one into the other, the US Dollar will need to act as a mediating currency.

A few of the minor pairs are:

EUR/GBP

Euro/British Pound (aka Chunnel)

EUR/AUD

Euro/New Zealand Dollar

CHF/JPY

Swiss Franc/Japanese Yen

GBP/JPY

British Pound/Japanese Yen (aka Gopher)

GBP/CAD

British Pound/Canadian Dollar.

Exotics

Exotics can include a major currency with an emerging market currency. Trading in exotics is considered risky, since they tend to have low liquidity, wider spreads and political instabilities in these countries can make these currencies volatile.

Some examples are:

EUR/TRY

Euro/Turkish Lira

USD/HKD

US Dollar/Hong Kong Dollar

AUD/MXN

New Zealand Dollar/Mexican Peso

In the brackets are the common nicknames for these currency pairs.

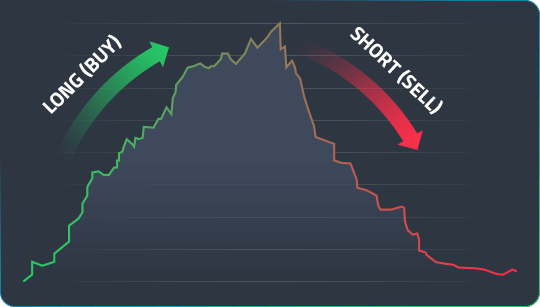

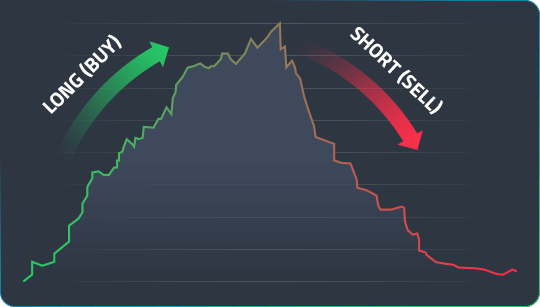

Going Long or Going

Short

When you assume a long position in a currency pair, you buy a currency in the hopes that its price will rise (appreciate) in the future. This means you wish to buy the base currency and sell the quote currency, since you expect the base currency to appreciate with respect to the quote currency.

When you assume a short position in a currency pair, you sell the base currency, expecting it to depreciate (decline in price) in the future, allowing you to buy it at a later date but at a lower price.

Lot Sizes

When you decide on your position size, a term you will hear is “lot.” Lots are standardised position sizes for currencies. The forex market gives you the flexibility to trade according to your means and risk profile. The standard size for a lot is 100,000 units of the base currency. There also are mini and micro lot sizes that contain 10,000 and 1,000 units of the base currency, respectively.

What is Liquidity in Forex Trading?

Liquidity in the forex market refers to the ability of a currency to be bought or sold on demand. When you trade in major currency pairs, there are a lot of buyers and sellers in the market. This means that there is always likely to be an opposite player for every position you take. You can buy or sell large amounts of these currencies without causing any significant difference to the exchange rate.

Liquidity fluctuates during trading sessions. You are likely to see significant activity during the overlapping of the New York and London sessions. Depending on your style of trading, you could benefit from choosing specific trading sessions. For instance, short term traders prefer the US or London sessions, when large price breakouts and percentile movements tend to occur. The Tokyo session is often range-bound, which might not be the best for them.

Liquid markets, such as forex, tend to fluctuate by smaller increments, since high liquidity means less volatility. However, high volatility can occur due to significant external events.

The Concept of

Leverage in Forex

Trading

Leverage in forex trading is a useful financial tool. It allows traders to gain greater exposure to market movements than they could otherwise afford. So, this means a trader can enter a position worth $100,000 with just $1,000 in their account, with a 100:1 leverage ratio.

The leverage amount is provided by the forex broker. Consider it as a loan, which can help you to increase your gains with little price increments. However, also remember that leverage magnifies your losses too, if prices move in the wrong direction. This is why, it is important to put in place robust risk management strategies while trading.

When you decide to trade, you need to open a margin account with a regulated broker. Here, you will need to deposit an initial margin amount that is required to keep your leveraged positions running.

This is also called deposit margin. When the amount drops below the minimum level, your broker will issue a margin call. This means that you need to deposit funds to keep your positions open. Otherwise, the broker may close your positions.

A 50:1 leverage ratio means a minimum margin requirement of 1/50 or 2% of the total trade value from you. Similarly, a 100:1 leverage ratio means that you need to deposit at least 1% of the total value of your trade in your margin account.

Technical and Fundamental Analysis

Using guesswork to predict the direction of price movement is not the best idea. Experienced traders carefully conduct market analysis, in order to determine the direction in which currency rates are likely to move. Two major approaches are used here: fundamental analysis and technical analysis.

Fundamental Analysis

Currency values fluctuate according to a nation’s perceived economic health. Fundamental analysis is the study of all factors that impact a country’s economy and is also representative of its future trends. When investors perceive a particular economy as being more rewarding than others, demand for the domestic currency increases, driving up its price. Fundamental traders look out for these indicators to gauge the economic health of a country.

Monetary Policy: The interest rates decided by a country’s central bank directly impact the domestic currency. When the interest rate increases, currency value tends to appreciate and vice versa.

Inflation Rate: Central banks are responsible for keeping inflation in check and promoting employment. To do so, they have various tools available, including the nation’s monetary policy, market interventions and quantitative easing.

Balance of Trade: The balance between a country’s exports and imports can impact currency values.

GDP Growth: The overall health of an economy is denoted by its GDP growth. Currency values tend to appreciate with a favourable GDP growth rate.

There are several other economic indicators, like employment rate, retail sales, manufacturing index and housing market data, that impact the forex market. To keep track of the economic releases, traders use an economic calendar. This is because significant volatility tends to ensue on the days that important reports are released. Based on whether the actual figures meet or beat market consensus, currency prices can go up or down.

Technical Analysis

Technical analysis is based on the principle that the markets tend to repeat their historical price trends. To discover these trends, traders rely on technical indicators and forex chart analysis. Technical indicators are actually statistical formulae that can provide important information about the market. They are categorised into:

Trend: Such as Simple Average, Trend lines, Moving Average Convergence Divergence (MACD)

Volume: Such as On Balance Volume (OBV), Chaikin Money Flow

Momentum: Such as Stochastic Oscillators, Relative Strength Index (RSI)

Volatility: Such as Average True Range (ATR), Volatility Index (VIX)

Forex trading platforms like MetaTrader 4 and MetaTrader 5 come with pre-installed technical indicators, allowing you to analyse the ongoing trends and any chances of price reversals. Based on these indicators, you can create forex trading strategies.

These platforms also allow you to use a combination of both fundamental and technical analysis. While fundamental analysis, through financial news alerts, allows traders to gauge the interest rate and inflation outlook for both currencies in a pair, technical indicators and charts provide insight into trends and ranges within the price history. Chart patterns can provide clues regarding how prices might move within the patterns and where they are likely to go after a break-out.